| Year |

US GDP Growth

Rate |

US Nominal GDP

(billions) |

US GDP per Capita |

US Household

Median Income |

US 95th

percentile HSD Income |

US Economic

Event |

US Unemployment

% |

US Prime Rate

(year end) |

US Median Home

Price |

RV Unit Shipments

(000) |

% Change From

Prior Year |

RV Retail Value

(billions) |

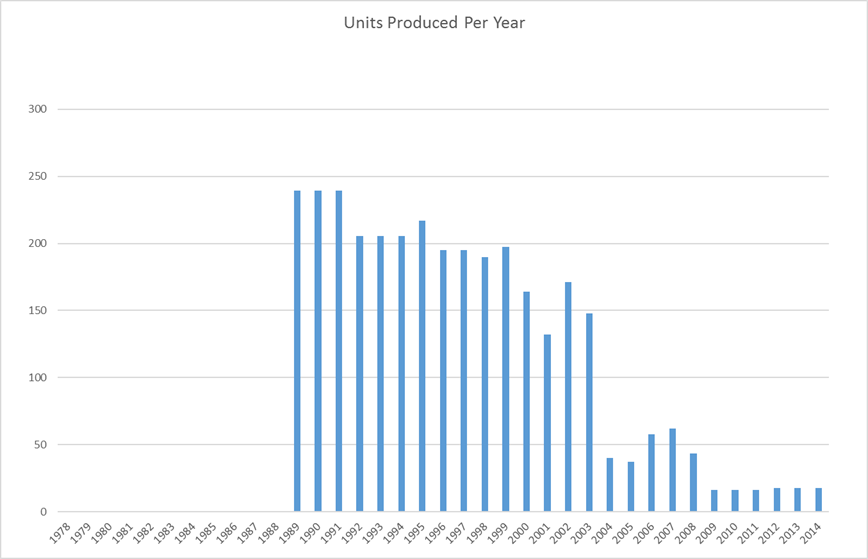

FT Units

(est)(calendar year units) |

FT Maximum base

MSRP |

FT Maximum base

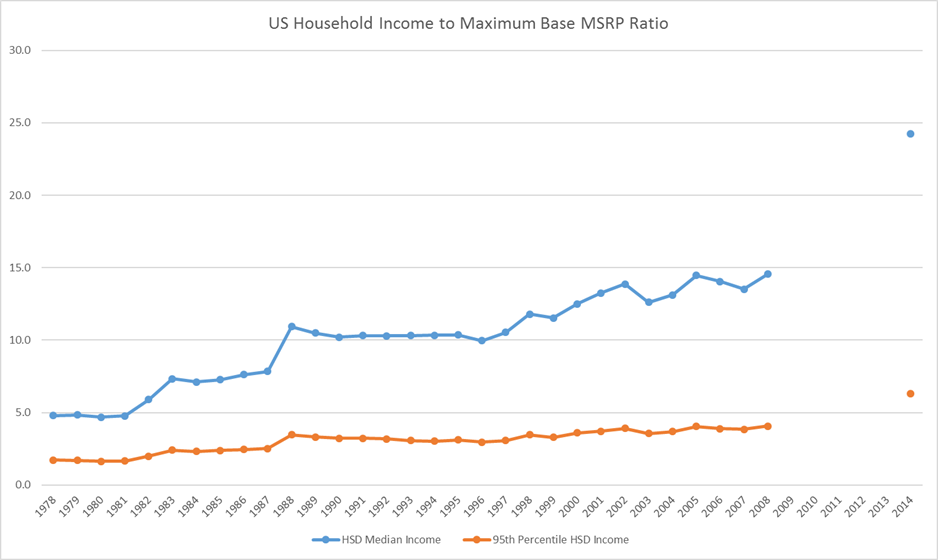

MSRP / HSD Median Income |

FT Maximum base

MSRP / 95th HSD Income |

FT Profit /

(Loss) (millions) |

FT President /

CEO |

FT Events |

|

| 1978 |

5.6% |

$

2,357 |

$

28,699 |

$

15,064 |

$

42,055 |

Fed raised rate

to 10% to fight 9% inflation. |

6.1% |

11.75% |

$

55,700 |

389.9 |

-5.8% |

4.077 |

|

$

72,295 |

4.8 |

1.7 |

|

C.M. Fore |

|

| 1979 |

3.2% |

$

2,632 |

$

28,775 |

$

16,461 |

$

46,860 |

Fed

raised rate to 15.5% to fight 13.3% inflation, then lowered it to 12%

confusing price-setters. Iran hostage crisis. Three Mile Island

disaster ends further nuclear construction in U.S. |

5.9% |

15.25% |

$

62,900 |

199.2 |

-48.9% |

2.123 |

|

$

79,625 |

4.8 |

1.7 |

|

C.M. Fore |

|

| 1980 |

-0.2% |

$

2,863 |

$

28,957 |

$

17,710 |

$

50,661 |

Fed

raised rate to 20%. GDP dropped 7.9% in Q2. Fed lowered rate to 10% by August

to boost economy, then raised it to 20% to fight 12.5%

inflation. Iran oil embargo. |

7.2% |

21.50% |

$

64,600 |

107.2 |

-46.2% |

1.168 |

|

$

82,850 |

4.7 |

1.6 |

|

C.M. Fore |

|

| 1981 |

2.6% |

$

3,211 |

$

27,982 |

$

19,074 |

$

55,200 |

Reagan became

President. Fed lowered rate to 12%. Inflation at 8.9%. 1981 recession began

in July. |

7.6% |

15.75% |

$

68,900 |

133.6 |

24.6% |

1.253 |

|

$

91,000 |

4.8 |

1.6 |

|

C.M. Fore |

|

| 1982 |

-1.9% |

$

3,345 |

$

28,167 |

$

20,171 |

$

60,086 |

Congress

passed Garn-St. Germain Act to fight recession. Removed. Fed lowered rate to

8.5%, since inflation was a moderate (in those days) 3.8%. |

9.7% |

11.50% |

$

69,300 |

140.6 |

5.2% |

1.879 |

|

$

118,900 |

5.9 |

2.0 |

|

C.M. Fore |

|

| 1983 |

4.6% |

$

3,638 |

$

30,307 |

$

20,885 |

$

63,500 |

Unemployment

was 10.8%. Reagan proposed Star Wars and increased military spending. |

9.6% |

11.00% |

$

75,300 |

196.6 |

39.8% |

3.485 |

|

$

152,930 |

7.3 |

2.4 |

|

C.M. Fore |

|

| 1984 |

7.3% |

$

4,041 |

$

31,428 |

$

22,415 |

$

68,500 |

The

Unemployment Rate drops to 7.2%, the same rate it was when the early 1980s

recession started in June 1981. |

7.5% |

10.75% |

$

79,900 |

215.7 |

9.7% |

4.393 |

|

$

159,500 |

7.1 |

2.3 |

|

C.M. Fore |

|

| 1985 |

4.2% |

$

4,347 |

$

32,453 |

$

23,618 |

$

72,004 |

|

7.2% |

9.50% |

$

84,300 |

186.9 |

13.4% |

3.936 |

|

$

171,500 |

7.3 |

2.4 |

|

C.M. Fore |

|

| 1986 |

3.5% |

$

4,590 |

$

33,036 |

$

24,897 |

$

77,106 |

Reagan

cut taxes. Chernobyl nuclear accident. |

7.0% |

7.50% |

$

92,000 |

189.8 |

1.6% |

4.031 |

|

$

189,500 |

7.6 |

2.5 |

|

C.M. Fore |

|

| 1987 |

3.5% |

$

4,870 |

$

34,148 |

$

26,061 |

$

80,928 |

Black

Monday stock market crash. Inflation at 4.4%. |

6.2% |

8.75% |

$

104,500 |

211.7 |

11.5% |

4.660 |

|

$

204,500 |

7.8 |

2.5 |

|

C.M. Fore |

|

| 1988 |

4.2% |

$

5,253 |

$

35,291 |

$

27,225 |

$

85,640 |

Fed

raised rate to 9.75% to combat 4.4% inflation. |

5.5% |

10.50% |

$

112,500 |

215.8 |

1.9% |

4.955 |

|

$

297,500 |

10.9 |

3.5 |

|

C.M. Fore |

|

| 1989 |

3.7% |

$

5,658 |

$

35,941 |

$

28,906 |

$

91,750 |

Bush

41 became President. Exxon Valdez oil spill. Invasion of

Panama. S&L Crisis caused recession. Fed lowered rate to 8.25%

to fight it, despite 4.6% inflation.Berlin Wall fell. |

5.3% |

10.50% |

$

120,000 |

187.9 |

-12.9% |

4.589 |

240 |

$

303,500 |

10.5 |

3.3 |

|

C.M. Fore |

|

| 1990 |

1.9% |

$

5,980 |

$

35,145 |

$

29,943 |

$

94,748 |

Iraq

invaded Kuwait. Dow fell 18% in 3 months. Inflation rose to 6.1%. |

5.6% |

9.50% |

$

122,900 |

173.1 |

-7.9% |

4.113 |

240 |

$

305,500 |

10.2 |

3.2 |

|

C.M. Fore |

|

| 1991 |

-0.1% |

$

6,174 |

$

35,694 |

$

30,126 |

$

96,400 |

Desert

Storm. 1991 recession. Breakup of Soviet Union. Fed lowered rate to 4%. |

6.9% |

6.50% |

$

120,000 |

163.3 |

-5.7% |

3.614 |

240 |

$

310,500 |

10.3 |

3.2 |

|

C.M. Fore |

|

| 1992 |

3.6% |

$

6,539 |

$

36,381 |

$

30,636 |

$

99,020 |

Fed

lowered rate to 3%. |

7.5% |

6.00% |

$

121,500 |

203.4 |

24.6% |

4.411 |

205 |

$

315,500 |

10.3 |

3.2 |

|

C.M. Fore |

|

| 1993 |

2.7% |

$

6,879 |

$

37,171 |

$

31,241 |

$

104,639 |

Clinton became

President. NAFTA and European Union signed into law.

World Trade Center bombed. |

6.9% |

6.00% |

$

126,500 |

227.8 |

12.0% |

4.713 |

205 |

$

322,500 |

10.3 |

3.1 |

|

C.M. Fore |

|

| 1994 |

4.0% |

$

7,309 |

$

38,008 |

$

32,264 |

$

109,821 |

|

6.1% |

8.50% |

$

130,000 |

259.2 |

13.8% |

5.691 |

205 |

$

333,500 |

10.3 |

3.0 |

|

C.M. Fore |

|

| 1995 |

2.7% |

$

7,664 |

$

38,544 |

$

34,076 |

$

113,000 |

Fed

raised rate to 6%. Inflation a moderate 2.5%. |

5.6% |

8.50% |

$

133,900 |

247.0 |

-4.7% |

5.894 |

217 |

$

353,000 |

10.4 |

3.1 |

|

C.M. Fore |

|

| 1996 |

3.8% |

$

8,100 |

$

39,825 |

$

35,492 |

$

119,540 |

Inflation

at 3.3%. |

5.4% |

8.25% |

$

140,000 |

247.5 |

0.2% |

6.328 |

195 |

$

353,500 |

10.0 |

3.0 |

|

C.M. Fore |

|

| 1997 |

4.5% |

$

8,609 |

$

41,176 |

$

37,005 |

$

126,550 |

Thailand

cut its dollar peg. Speculators sold all Asian currencies. |

4.9% |

8.50% |

$

146,000 |

254.5 |

2.8% |

6.904 |

195 |

$

389,500 |

10.5 |

3.1 |

|

C.M. Fore |

|

| 1998 |

4.5% |

$

9,089 |

$

42,663 |

$

38,885 |

$

132,199 |

Russia

debt default. Long Term Capital Management hedge fund nearly

collapsed. Fed lowered rate to 4.75%. |

4.5% |

7.75% |

$

152,500 |

292.7 |

15.0% |

8.364 |

190 |

$

459,000 |

11.8 |

3.5 |

|

C.M. Fore |

|

| 1999 |

4.7% |

$

9,661 |

$

43,935 |

$

40,696 |

$

142,000 |

Y2K

scare boosted tech purchases. Budget surplus. Euro

created.Glass-Steagall repealed. Fed raised rate to 5.5%. |

4.2% |

8.50% |

$

161,000 |

321.2 |

9.7% |

10.413 |

197 |

$

469,000 |

11.5 |

3.3 |

$

2.400 |

Ray Fore |

|

| 2000 |

4.1% |

$

10,285 |

$

44,492 |

$

41,990 |

$

145,220 |

Tech

bubble burst. Fed raised rate to 6.5% to fight 3.4% inflation. |

4.0% |

9.50% |

$

169,000 |

300.1 |

-6.6% |

9.529 |

164 |

$

524,500 |

12.5 |

3.6 |

$

1.800 |

Ray Fore |

Foretravel paint shop

opened by James Stallings |

| 2001 |

1.0% |

$

10,622 |

$

44,687 |

$

42,228 |

$

150,499 |

Bush

43 became President. Recession worsened by 9/11 attacksand War on

Terror, but helped by EGTRRA, the first Bush tax cut. Fed started

lowering rates. |

4.7% |

4.75% |

$

175,200 |

256.8 |

-14.4% |

8.598 |

132 |

$

559,750 |

13.3 |

3.7 |

$

(3.300) |

Ray Fore |

|

| 2002 |

1.8% |

$

10,978 |

$

44,996 |

$

42,409 |

$

150,002 |

Bush

calls for regime change in Iraq, creates Homeland Security. |

5.8% |

4.25% |

$

187,600 |

311.0 |

21.1% |

10.960 |

171 |

$

588,000 |

13.9 |

3.9 |

$

(0.483) |

Ray Fore |

|

| 2003 |

2.8% |

$

11,511 |

$

46,560 |

$

43,318 |

$

154,120 |

Unemployment

at 6%. Fed lowered rate to 1%. Bush enactedJGTRRA tax cut for

businesses. Iraq War began. |

6.0% |

4.00% |

$

195,000 |

320.8 |

3.2% |

12.058 |

148 |

$

546,750 |

12.6 |

3.5 |

$

(5.300) |

Ray Fore |

layoff of 350

employees, from 550 to 200; closed 5 of 6 factory-owned stores |

| 2004 |

3.8% |

$

12,275 |

$

47,800 |

$

44,334 |

$

157,152 |

Fed

started raising rates. |

5.5% |

5.25% |

$

221,000 |

370.1 |

15.4% |

14.700 |

40 |

$

581,500 |

13.1 |

3.7 |

$

(7.600) |

Ray Fore |

Foretravel misses

payroll; |

| 2005 |

3.3% |

$

13,094 |

$

48,856 |

$

46,326 |

$

166,000 |

Hurricane

Katrina cost $250 billion in damage. |

5.1% |

7.25% |

$

240,900 |

384.4 |

3.9% |

14.366 |

37 |

$

670,652 |

14.5 |

4.0 |

$

(9.000) |

Lyle Reed |

Company

sold to investment group: Lyle Reed, Greg Amys, Frank Sheeder Jr. & Dr.

Dane Miller; Reed invests ~$500k; James Stallings opens Xtreme Paint &

Graphics location in Nacogdoches |

| 2006 |

2.7% |

$

13,856 |

$

48,987 |

$

48,201 |

$

174,012 |

Fed

funds rate raised to 6.75%. Swine flu epidemic. |

4.6% |

8.25% |

$

246,500 |

390.5 |

1.6% |

14.732 |

58 |

$

676,840 |

14.0 |

3.9 |

|

Lyle Reed |

|

| 2007 |

1.8% |

$

14,478 |

$

49,060 |

$

50,233 |

$

177,000 |

Dow

reached new high of 14,164.43. Inflation at 4.1%. Fed dropped rate 3 times,

to 4.25%, to ease banking liquidity crisis. LIBOR rose to 5.6%. |

4.6% |

7.25% |

$

247,900 |

353.4 |

-9.5% |

14.504 |

62 |

$

678,615 |

13.5 |

3.8 |

|

Lyle Reed |

Foretravel sues Fore

family |

| 2008 |

-0.3% |

$

14,719 |

$

46,941 |

$

50,303 |

$

180,000 |

Stock

market crash of 2008 led to global financial crisis and $350

billion spent on bank bailout bill. Fed lowered rate 7 times to 0%.

See2008 GDP by quarter. |

5.8% |

3.25% |

$

232,100 |

237.0 |

-32.9% |

8.758 |

43 |

$

732,175 |

14.6 |

4.1 |

|

Lyle Reed |

Foretravel sues MOT,

case is settled; |

| 2009 |

-2.8% |

$

14,419 |

$

47,280 |

$

49,777 |

$

180,001 |

Obama became

President. Dow dropped to 6,594.44. Obama Stimulus Act spent $400

billion, reversed downward spiral. See 2009 GDP by quarter. |

9.3% |

3.25% |

$

216,700 |

165.7 |

-30.1% |

5.152 |

16 |

|

|

|

|

Greg Amys |

|

| 2010 |

2.5% |

$

14,964 |

$

47,805 |

$

49,276 |

$

180,485 |

BP

oil spill. Bush tax

cuts extended. Obamacare and Dodd-Frankpassed.

See 2010 GDP by quarter. |

9.6% |

3.25% |

$

221,800 |

242.3 |

46.2% |

8.732 |

16 |

|

|

|

|

Greg Amys |

|

| 2011 |

1.6% |

$

15,518 |

$

48,756 |

$

50,054 |

$

186,000 |

Japan

earthquake and Mississippi River floods. 10-year Treasury yield

hit 200-year low. Iraq War ended. |

8.9% |

3.25% |

$

227,200 |

252.3 |

4.1% |

9.028 |

16 |

|

|

|

|

Greg Amys |

|

| 2012 |

2.3% |

$

16,155 |

$

48,992 |

$

51,017 |

$

191,156 |

Presidential

campaign and fiscal cliff created business

uncertainty.Superstorm Sandy hit East Coast. See U.S. Economy 2012 |

8.1% |

3.25% |

$

245,200 |

285.9 |

13.2% |

10.835 |

18 |

|

|

|

|

Greg Amys |

|

| 2013 |

2.2% |

$

16,663 |

$

49,405 |

$

51,939 |

$

196,000 |

Slow

growth due to sequestration. Low nominal GDP growth thanks to low

inflation. GDP per capita returned to pre-recession level. |

7.4% |

3.25% |

$

268,900 |

321.1 |

12.4% |

12.984 |

18 |

|

|

|

|

Greg Amys |

|

| 2014 |

2.4% |

$

17,348 |

$

50,456 |

$

53,657 |

$

206,568 |

Growth

increased as the economy got back on its feet, and inflation remained

low. Fed ended Quantitative Easing. |

6.2% |

3.25% |

$

282,800 |

356.7 |

11.1% |

15.396 |

18 |

$

1,300,000 |

24.2 |

6.3 |

|

Lyle Reed |

|

| 2015 |

2.4% |

$

17,947 |

$

56,300 |

|

|

Strong

dollar hurt exports. Oil prices collapsed. |

5.3% |

3.50% |

$

296,400 |

374.2 |

4.9% |

|

18 |

|

|

|

|

Lyle Reed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sources: |

|

|

Prime rate 1978-82: |

|

https://research.stlouisfed.org/fred2/data/PRIME.txt |

|

|

Prime rate 1982-2015: |

|

https://www.jpmorganchase.com/corporate/About-JPMC/historical-prime-rate.htm |

|

|

GDP: |

|

http://useconomy.about.com/od/GDP-by-Year/a/US-GDP-History.htm |

|

|

Unemployment: |

|

http://data.bls.gov/timeseries/LNS14000000&sa=U&ved=0ahUKEwjsi9-TnbnMAhWHWCYKHd5lCu8QFggEMAA&client=internal-uds-cse&usg=AFQjCNGe3tMyN7lsuDIbZX3F-UycL1K_zQ |

|

|

RV units & value: |

|

http://www.rvia.org/?ESID=histglance |

|

|

FT units: |

|

http://www.foreforums.com/index.php?topic=23217.50 |

|

|

FT Profit/(Loss): |

|

http://dailysentinel.com/news/local/article_518210cd-6a18-52e9-adb9-3fdd376b5d57.html |

|

|

Lyle Reed investment amount: |

|

http://www.foreforums.com/index.php?topic=5359.msg22066#msg22066 |

|

|

Household median income (current

dollars): |

|

https://www.census.gov/hhes/www/income/data/historical/household/ |

|

|

Foretravel maximum base list

price: |

|

NADA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|